May 24, 2022

In this reaction video, I listen to a Chris Martenson from Peak Prosperity in a recent video titled I Give Up. I have the utmost respect for Chris due to his sound money views and priceless expert opinion during the early days of the Corona Virus, but his economic claims about energy and the economy required a response.

I cover a lot of ground in this episode, including basic economics of complex systems, the central planning fallacy, US oil production, the peak oil fallacy, and contrast a pessimistic macro outlook and an optimistic outlook.

Where, How, and By How Much?

A problem with most people's macro analysis is the lack of specificity. They use oversimplified terms and claims that would fall apart upon deeper examination.

They would find out the affects of a coming recession on different areas of the world will be different, and they'd have to determine that the US is not in that bad of shape relative to other major economies and blocks.

However, they have already determined the US is on the road to massive social upheaval and the end of some perceived unusual period of unfairness. Examining relative economic conditions, and the reasons behind those deep historical differences in economic advancement by geographic region, will not support their predetermined outcome.

We must ask anyone preaching a coming global manmade catastrophe, some simple questions. 1) Where exactly will the economic stress by most acute? 2) How will that country or region deal with these acute economic conditions? 3) How bad will it get for them relative to other places?

Independent Variables

To reach a catastrophic conclusion, one must start by introducing an independent variable into the economic mix. Of course, this is impossible, there are no independent variables in nature or economics.

When we compare nature with the market, let us compare individuals to species and the market to the larger ecological system. There are certainly cases where individual species may become endangered or even extinct. And in a market, individuals will rise or fall, even die. However, the entire system is not so fragile to begin a downward feedback loop to zero.

So, economic variables will change, but that will have been induced by previous changes, and in turn cause future changes. There are no independent variables in the market.

This is important when evaluating Chris' arguments about energy. He claims the energy supply will independently be reduced. He uses charts showing a very close relationship to energy usage and GDP. But instead of inferring that GDP causes energy usage, he concludes that energy usage causes GDP.

I hope you see the backward inference. One way supposes energy usage is an independent variable, while the other way views it as a dependent variable.

US Shale Oil

One of the premises that Chris uses for his argument is a belief in peak oil. The theory is carefully crafted to exclude new sources of oil. It claims that we are running out of easily accessible oil, and production from that easily accessible oil will slowly taper for the next 50 years until we are out of it.

As I said though, this theory excludes new sources of oil, like oil sands and very importantly oil shale. In the last 15 years, new technology has come around that has enabled US shale oil producers to economically extract shale oil. This is a very big deal because shale oil reserves dwarf conventional reserves by at least 3.5:1 as of current estimates.

The US is home to 80% of extractible shale, estimated to be roughly 4-5 trillion barrels, compared to all of the world's conventional reserves of 1.6 trillion barrels.

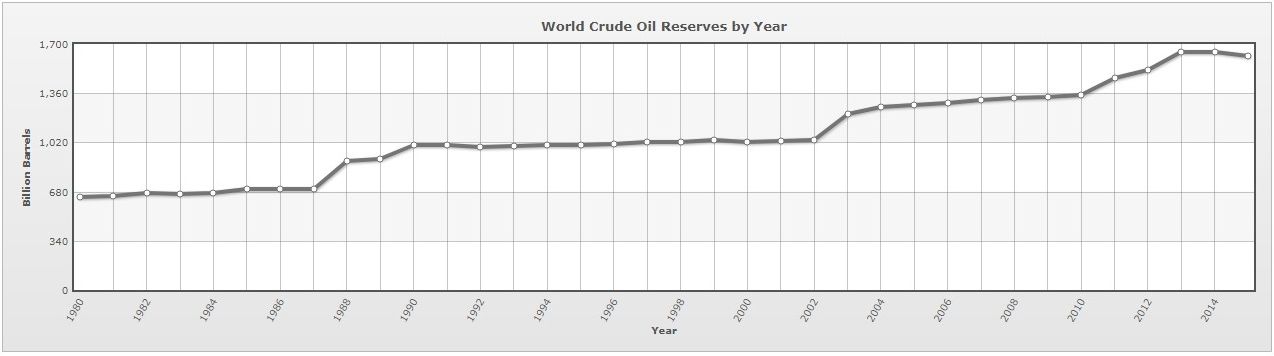

The problem is also, not nearly as bad as peak oil promoters will have you believe, because conventional oil reserves still tend to increase every year, despite extracting approximately 75 million barrels a day.

The above chart stops in 2015, so I'll add the last data point from another source. In 2020, global conventional oil reserves were 1.732 trillion barrels, that is more than 100 billion barrels more than 2015 on this chart.

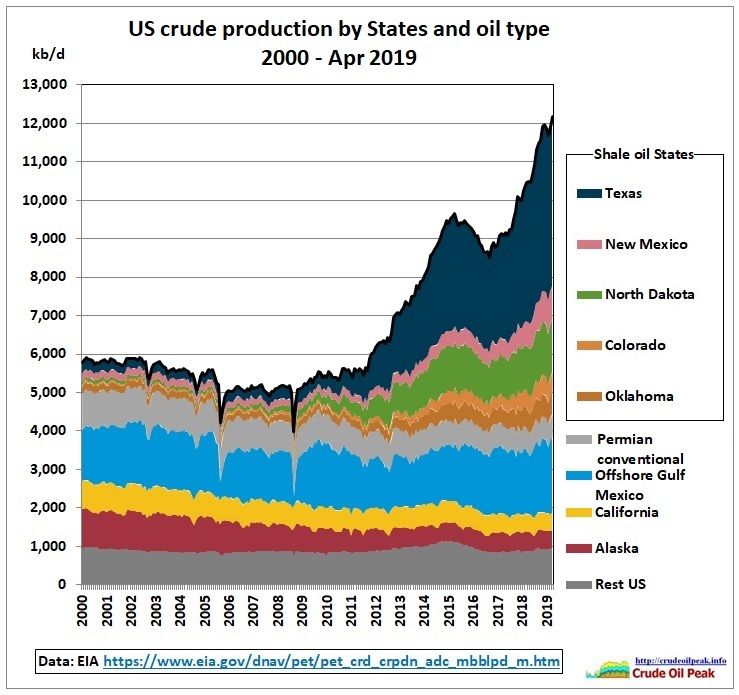

Here is shale's contribution to production.

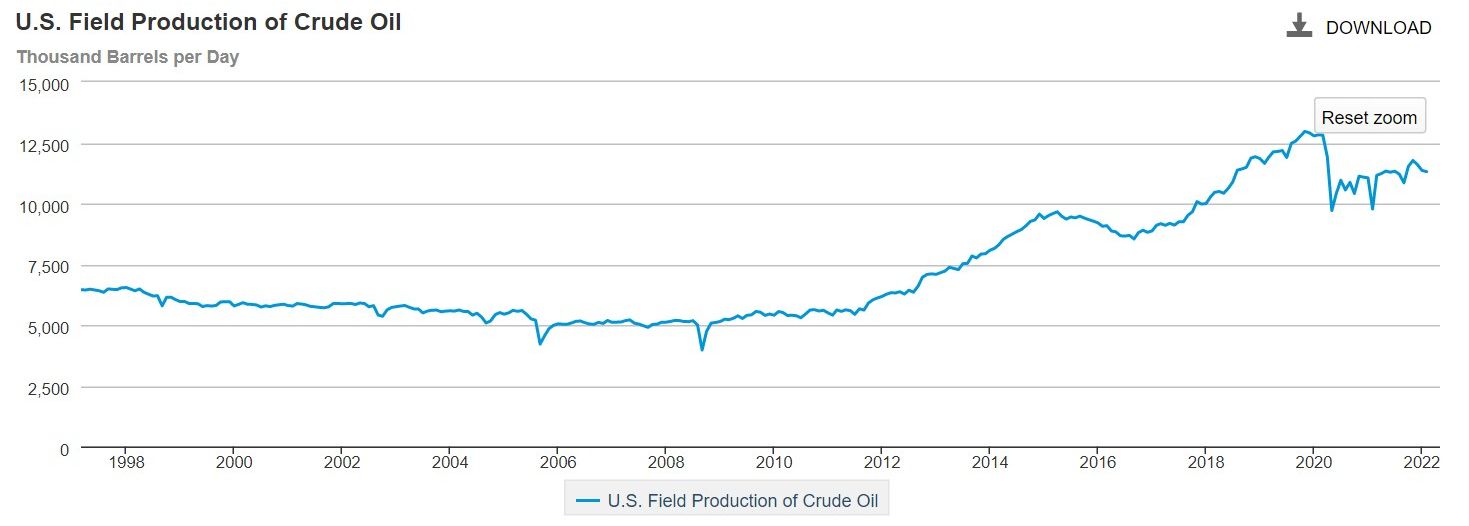

US production had a bad time in covid but is already coming back, despite the administration's attempt to humble US production.

Conclusion

Chris' community and aims of his content are noble. He mainly tries to steer people toward sustainable living and long term planning for your family. I admire that in him, and admire what he has accomplished with his homestead and his community. However, his ideas on peak oil, which he has professed for over a decade now, are simply wrong.

Oil production is a dependent variable, just like all other economic variables. Economic activity does not grow into the available energy, because that energy would not be extracted if it wasn't the result of economic planning and activity. Oil production is the result of economic activity, not the other way around.

That is why when Chris looks at relationships between energy usage and GDP they are highly correlated. It's because they are measuring the same thing.

I know the market is smarter than I am at all times and in everything. I attempt to understand what the market is telling me, not try to figure out how the market is wrong.

Until next time.